Press Releases

Ferguson Introduces Bipartisan Downward Attribution Technical Correction

Washington,

September 27, 2023

Congressman Drew Ferguson (R-GA), Congresswoman Gwen Moore (D-WI), Congressman Ron Estes (R-KS), Congressman Jimmy Panetta (CA-D), Congresswoman Michelle Steel (R-CA), and Congressman Brad Schneider (IL-D) today introduced the legislation that would address the uncertainty in present law that would cause some U.S. business taxpayers to face an unexpected and unknowable tax liability due to the mechanical application of Section 984(b)(4) repeal. This important legislation would amend the Internal Revenue Code of 1986 to restore the limitation on downward attribution of stock ownership in applying the constructive ownership rules to controlled foreign corporations. The bill provides a technical correction to the 2017 Tax Cuts and Jobs Act felt by business taxpayers investing outside of the United States who are unable to acquire the tax information necessary to accurately determine their global tax liability.

“This legislation reflects the intent of Congress when the 2017 Tax Cuts and Jobs Act was passed to no longer unintentionally force U.S. companies to have to report higher – and unfair – tax liabilities on assets they are not proprietary owners of from foreign subsidiaries around the globe,” said Congressman Drew Ferguson. “This legislation is a technical correction that will allow U.S. companies with a global presence to compete fairly around the world.”

“I am committed to working across the aisle and championing effective tax policy,” said Congresswoman Gwen Moore. “Today, I join my Ways and Means colleagues in advancing a bipartisan proposal that secures a technical fix to a Tax Cuts and Jobs Act provision and addresses its ongoing, unintended consequences.”

“From time to time, lawmakers have opportunities to make common sense technical changes that will have great impacts on their constituents and the U.S. economy,” said Congressman Ron Estes. “The Downward Attribution Technical Correction addresses the unintended consequences of downward attribution for U.S. stakeholders and stabilizes disruption to the U.S. tax code.”

Click here for bill text.

|

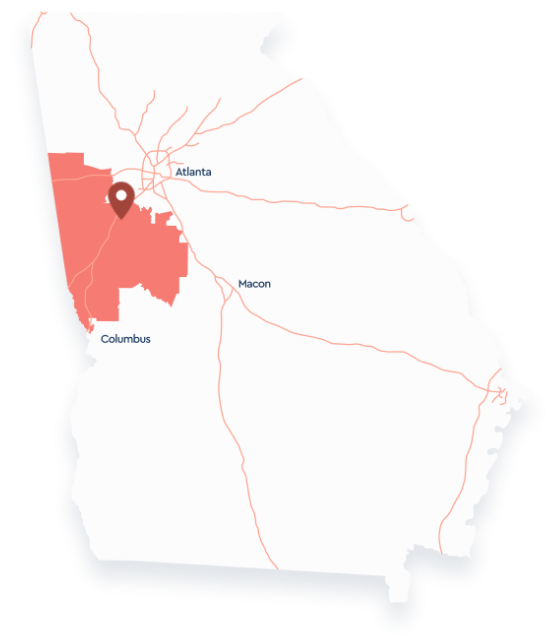

Office Locations

We look forward to meeting with you and developing lasting relationships that can have a major impact on our district and beyond.