Press Releases

Ferguson Introduces First Bill: Legislation Will Close Tax Loophole

Washington, DC,

April 5, 2017

Tags:

Taxes

Congressman Drew Ferguson (R-Ga.) today introduced his first bill as a Member of Congress. The bill, the Child Tax Credit Protection Act, would close a loophole in current tax law that allows unlawful individuals to claim the Child Tax Credit (CTC) deduction without providing a valid social security number. The CTC was put in place to provide a tax credit for lower income Americans with children. Although Congress has taken steps to increase program integrity, current law still allows individuals to use an Individual Tax Identification Number (ITIN) rather than a social security number to claim the CTC. Unfortunately, this gap in the current law permits individuals who do not qualify to wrongfully claim the Child Tax Credit. “I am proud to introduce legislation which closes just one of the many loopholes in our tax code that are ripe for abuse. The CTC loophole only highlights the serious need for tax reform, and I sincerely hope that the Child Tax Credit Protection Act can be included as part of that comprehensive effort,” said Ferguson. “We must protect the integrity of our tax code and ensure that benefits are reserved for those it was intended to serve.”

|

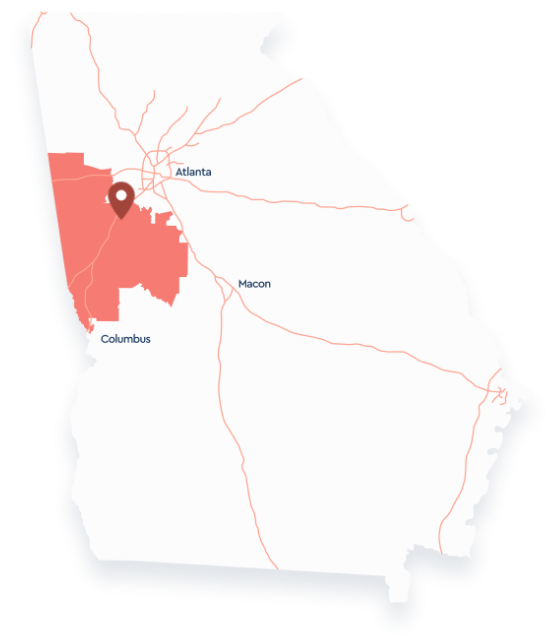

Office Locations

We look forward to meeting with you and developing lasting relationships that can have a major impact on our district and beyond.