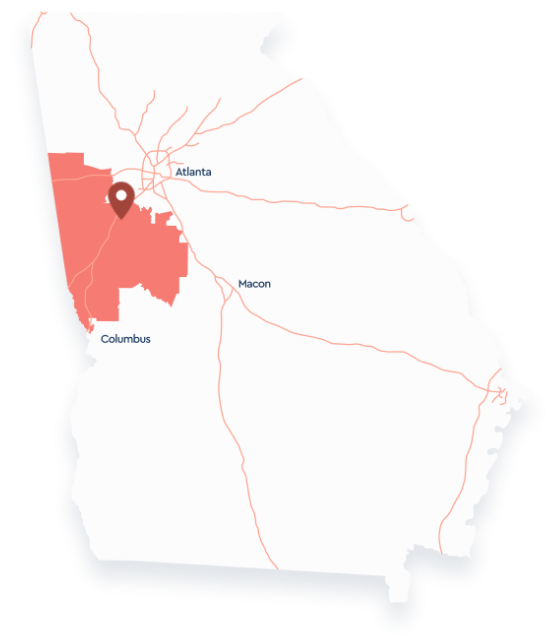

U.S. Congressman Drew Ferguson (GA-03) today introduced H.R. 8913, the Protecting American Students Act. The bill amends the scope of the Endowment Tax calculation to only account for students eligible for federal financial assistance under the Higher Education Act. This includes students who are a citizen, national, or permanent resident of the United States or able to provide evidence from the Immigration and Naturalization Service that he or she is in the United States for other than a temporary purpose with the intention of becoming a citizen or permanent resident. The bill does not include students who are in the U.S. temporarily or on a student visa.

“The rising antisemitic behavior on college campuses is beyond unacceptable, and many leaders of these movements are international students,” said Congressman Ferguson. “United States educational institutions should not be rewarded with generous tax benefits while condoning this behavior, and the Protecting American Students Act ensures these universities create a safe environment for all students.”

Original Cosponsors: Representatives Mike Kelly (PA-16), Carol Miller (WV-01), Gregory Murphy (NC-03), David Kustoff (TN-08), Claudia Tenney (NY-24), Blake Moore (UT-01), Nicole Malliotakis (NY-11), and Elise Stefanik (NY-21)

Background:

As the Committee on Ways and Means work has shown, in the wake of the Hamas terrorist attack in Israel on October 7, America’s so-called elite institutions have harbored and promoted antisemitic behavior while allowing Jewish students to be threatened, harassed, and assaulted. Data and public reporting make clear that malign foreign influence, including some students present in the United States on temporary student visas, has directly contributed to the rise in antisemitic behavior on college campuses.

At the same time, public reporting indicates that the number of foreign students at American universities, especially at Ivy league schools, has grown significantly in recent years. Reporting indicates that the average number of foreign students at Ivy league schools is around 25%, reaching as high as 50% at some institutions.

In order to promote tax fairness among private foundations and tax-exempt organizations – particularly private colleges and universities – the Trump tax cuts established the Endowment Tax. Currently, the Endowment Tax is a 1.4 percent excise tax on the net investment income (NII) of a private college or university endowment. To be within scope of the tax, the institution in question must have at least 500 “tuition-paying” students and an endowment value of at least $500,000 per “full-time” student. Roughly 35 institutions fall into scope of the Endowment Tax in any given year.